Why crypto YC will be bigger than the original

And the man who tokenized himself

This is part 2 of my series “The audience grows the creator.” Part one can be found here. Subscribe to follow my journey into the increasingly powerful and dynamic role the audience plays in growing the creators they love, and the ways creators are incentivizing that work.

“Private membership communities are the new church”

-Greg Isenberg

If private membership communities are the church, social tokens are a digital representation of devotion to the faith. They’re earned by donations on the collection plate. They pay for efforts to recruit new members. And they reward the devout with a place of status in the community, maybe even a place in financial heaven some day. Multiply the optimism of the Bitcoin zealots by the devotion of the Discord diehards and you can understand the magnitude of excitement around the explosion of new community cryptocurrencies. They offer a new way to incentivize the driving forces of digital value.

So what is a social token, in simple terms? Imagine if you and 100 of your friends all decide to colonize a new planet, but all you have with you is your laptops and an internet connection. As you work to build up your new civilization, you want some system of currency in order to store value, incentivize certain actions, maybe even get some investment from people still on earth. You use one of several social token issuers to help create your version of $Bitcoin, armed with all of the technical innovations that make people lose their $hit over cryptocurrencies. You call it $EARTHSUCKS and then build your entire social system around that new currency. Maybe recruiting new colonizers to your planet gets you one coin, buying a nice crater for your home costs three. That’s exactly what social tokens are, except instead of a new planet it’s an online community.

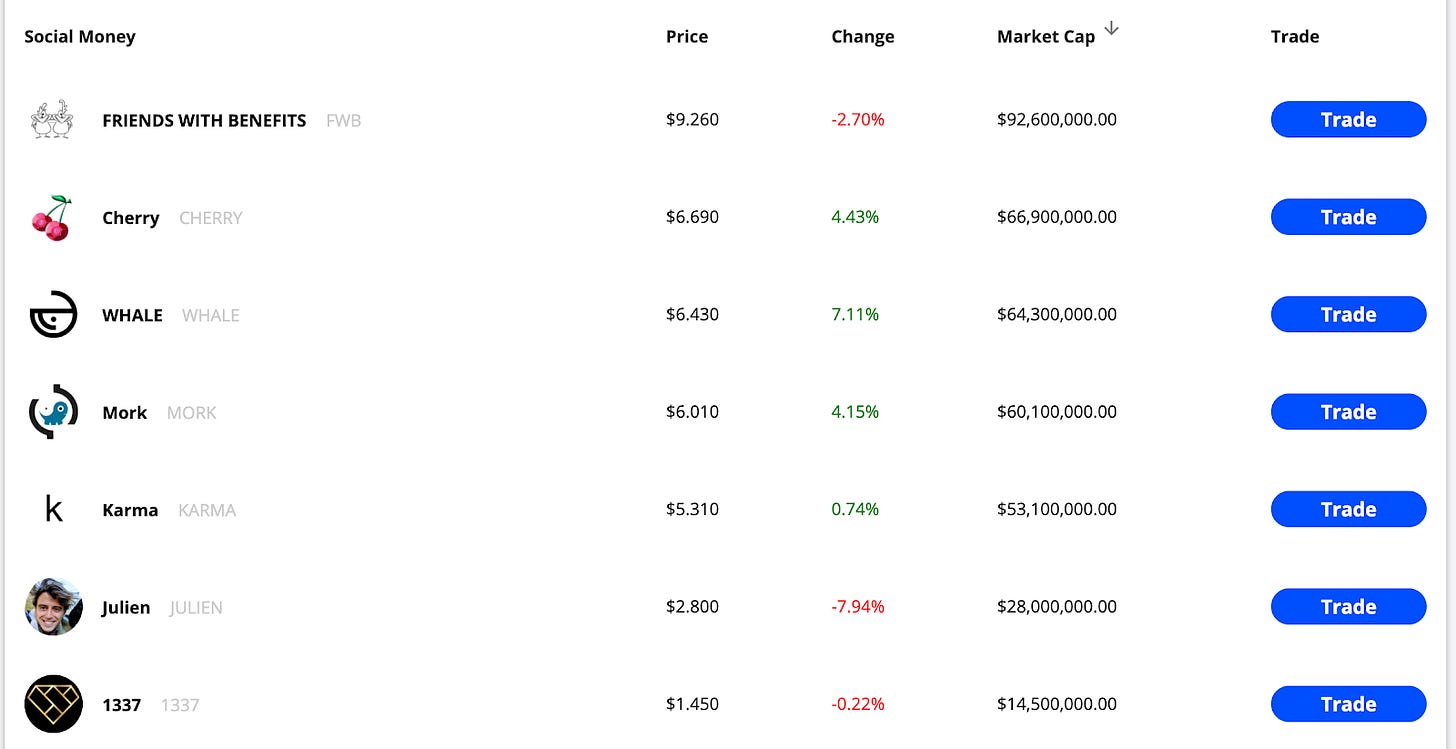

Social tokens offer a deep well of inspiration for creators and community builders, but dipping in means getting past the fact that they’re almost unfathomably…different. Creators and creator communities are minting their own cryptocurrencies, often with amusing names like $WHALE or $MORK — “how much Mork can you get for one WHALE these days” is a sentence that actually has meaning. Before you dismiss this as fantasy, consider that the total market cap of these social tokens is well over half a billion dollars and growing fast. Understanding their rapid rise can help us learn more about the true levers of value creation in an online community as it scales.

But first, why is facilitating community value so important in the first place?

Bigger, more powerful communities

Many see the growth of online communities as a rebound from the reality-fracturing effect of our current online world. “Reality is up for grabs” says OnDeck founder and community builder extraordinaire Erik Torenberg. “Community builders who make sense of the world and provide a vision of the future—will emerge to fill the void that this fragmentation creates.” That explains why seemingly every rocketship newsletter lands on planet Slack or Discord these days; living, dynamic communities need living, dynamic tools—not just static articles.

But growing and maintaining private communities is incredibly difficult. So why do it? A simple reason is that communities unlock a new depth of motivation for the audience to invest in the creator’s growth and/or revenue. And as I laid out in “The audience grows the creator” that means community building offers exponential returns to creators that can do it well. Social tokens theoretically allow the creator to perfectly and dynamically align a wide variety of community investment with value. Sounds amazing, but the theory itself is still understandably hard to buy on its own. That’s why I want to tell the story by diving straight to the ground floor, and talk about experiments currently being led by two pioneers who I was fortunate enough to interview. Starting with Alex Masmej, or as a Coindesk article puts it, “the man who tokenized himself.”

Alex and $ALEX

Frankly, Alex Masmej at 24 has run enough interesting experiments to fill a book. But I am not writing a book, so I will give you the 10,000 ft version and try to lay out some key features of social tokens along the way:

Coin minting: he created his own currency, $ALEX, via the leading coin issuing product, Roll. Like Bitcoin, $ALEX’s predefined quantity makes it immune to inflation and its value relative to the dollar or other currencies changes based on demand.

Establishing liquidity: he sold $20,000 worth of $ALEX for 15% of his income over the following 3 years. So in other words if he averages $222k over those 3 years, the investors get a 5X return. If he averages 45k over those 3 years, they break even. So far, his investors are making more than their investment. They also get to keep the $ALEX.

Building a marketplace: he has created a lot of other things his community can do with $ALEX, from booking time with him to literally controlling his life, to subscribing to his newsletter. He also gives coins away to facilitate key actions like sharing his articles.

Alex took that $20k and was finally able to move to the United States, and in an interview from his new apartment he made it clear that all of these bold new experiments are held together by one other key ingredient—his reputation:

There's no formal documents, they have to trust me. And here, the reason why this worked for me, and this might not work at scale, is that I am a little bit known in the crypto space. And so my reputation is my collateral.

Reputation is what allows you to trust that as the value of $ALEX increases, Alex will continue to find ways to return that value to the shareholders. It’s a vote of trust and a bet on his future growth, one that incentivizes his audience to help him get there.

Seed Club and the YC of social tokens

To recap everything so far, social tokens allow audience members to participate in a marketplace of community building activities. They can earn tokens by investing with money, or with their time or their own stores of social capital — on things like acquiring new members, curating content, whatever the community needs. Those tokens then unlock all sorts of value, from revenue-sharing to social status. Trust in the transactions comes from blockchain, but trust in the currency itself comes from the reputation and future upside of the creator/community. And that’s where Seed Club, a recently launched social token incubator, comes in. Very similar to YCombinator, Seed Club takes a cut of stock (3% of tokens) in exchange for guidance, connection to other creators, and other support.

The comparison to YC is, on the one hand, flattering. YC’s portfolio is now upwards of $300B in combined valuation, but more impressive to me is the sheer number of beloved companies in that list: AirBnB, Doordash, Instacart, Gusto, Stripe, Segment, Dropbox, Coinbase — it goes on and on. But despite YC’s incredible run, some of Seed Club’s key differences actually suggest that the same model applied to social tokens could be even more powerful. Most notably, success can be shared much more directly between creators than between companies, as cross-promotion and collaboration experiments like Hypehouse have shown.

As Seed Club cohorts age and become more successful, they are also incentivized to help new cohorts get off the ground because Seed Club gives shares of its own currency to every new batch. Using tokens as essentially “votes” in deciding how the community is run is not unique to Seed Club - it’s a common feature of crypto called DAO (decentralized autonomous organization) and there is a rich history for them to rely on for inspiration. Jess Sloss, the magnetic founder of Seed Club, even told me in an interview “it's our belief that we can get to a point where our community is being run in a decentralized-ish way.” Revenue/profit sharing is one additional build that Jess himself seems pretty excited about. Just as modern creators are finding huge success in distributing the work/reward to their communities, Seed Club is attempting to do this with a community of creators-with-communities. I’ve worked for a lot of different founders over the past decade, and based on our short conversation I get the feeling that Jess would be one to stake your reputation behind and follow.

Giant leap forward for innovation, or just a dream?

Over the past year I’ve joined a number of Slack and Discord communities, from OnDeck to Means of Creation to a few more science-specific. There is little doubt in my mind that incentivizing the depth and breadth of investment in curation and maintenance from community members is a challenge to any community as it scales. Even without social tokens, there are ways good communities are tackling that problem. For example, a common theme I’ve seen is to essentially elevate the social status of highly valuable members so that they receive value from the community proportional to the value they offer.

What social tokens offer is a much more robust way to reward community building for communities where tokens make sense. Some members can invest via hours of manual work, others via their Twitter followers and ability to acquire new members, and others simply via their bank accounts. The community can decide what the relative value of each of those investments is depending on what is needed at the time. Tokens also solve a challenging problem for communities which is that early adopters often do the hard work of establishing the community but don’t receive value proportional to that effort. They are the early employees, but the community has no employee stock program. Social tokens solve that since the value of the token will rise as demand for it grows, and no doubt some early community members will get rich. They also prevent dilution since the number of tokens is set in advance.

The main counter to social tokens is that they commoditize social activities in a way that makes them lose their intrinsic social value. Instead of sharing an article because you love it, you share it to get a coin. This is a very valid counterargument, and there will be a wide host of communities where social tokens do not make sense, namely those where there is no community building work which is otherwise difficult to incentivize. But consider examples like Reddit, Stack Overflow, ProductHunt etc where some version of Karma points are leveraged to reward community values and unlock deeper returns for audience members willing to invest. There is gamification in all of those cases, but each is also a community at nearly unmatched scale in its space that is able to collaboratively curate information. The use of explicit “community points” in those communities in some ways feels less socially corrupt than places like Twitter where social status games try in vain to hide behind so many retweets and comments.

What is undeniably true in all of this is that people like Jess and Alex and the rest of the social token community are on fire, and running some experiments that would turn many skeptics into believers. Even if you haven’t already loaded some extra Ether into your virtual wallet so that you can go buy $ALEX before it climbs past the $2M market cap, you would be wise to follow along as this space develops.

Special thanks to Jess Sloss and Alex Masmej for their gracious donation of time to this piece

THIS IS SO VALUABLE THANK YOU